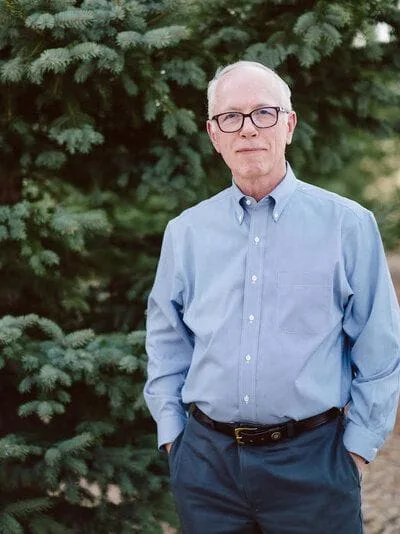

John Husson, a Reputable Colorado ATTORNEY SKILLED IN ESTATE PLANNING INCLUDING WILLS, TRUSTS, POWERS OF ATTORNEY, LIVING WILLS AND OTHER ADVANCE HEALTHCARE DIRECTIVES AS WELL AS MARITAL AGREEMENTS (INCLUDING PRE-MARITAL AGREEMENTS ALSO COMMONLY KNOWN AS PRENUPTIAL AGREEMENTS)

Committed to providing sound legal counsel to his front range area clients

Husson Law LLC is a respected law firm representing clients in Estate Planning and Marital Agreements. Based in Denver and Castle Rock, John Husson has represented clients in courts throughout the Denver area and throughout all of Colorado. He has the necessary experience to help you create a successful estate plan for you and your family. Please read his profile to learn more about his extensive professional background.

Husson Law LLC has a thorough understanding of Colorado law and works hard to help you get the best possible results in the following practice areas:

Estate Planning — We provide estate planning services for clients throughout Colorado.

- Living Wills and Other Advance Healthcare Directives — These documents will allow you to make clear how your medical care should be managed for end-of-life care. John helps clients create advance healthcare directives meeting your personal wishes.

- Powers of Attorney — Financial and Medical. John is an experienced lawyer, working with individuals and businesses to ensure that the legal authority for medical and financial decisions is transferred in the event of a person's incapacity.

- Trusts — There are many different types of trusts, each with its own rules and benefits. John Husson, a trusted estate planning attorney can help you establish one appropriate for your assets and goals.

- Wills — Your last will and testament will include instructions for how your assets will be distributed among your family members and other beneficiaries of your choice. In addition, your will contains guardianship language to address who should care for your minor children.

Prenuptial & Postnuptial Agreements — Our firm helps couples establish the terms of a settlement agreement either before or after they are married to protect both parties in the event that they later decide to get a divorce. If you need to draft a prenuptial or postnuptial agreement, contact our experienced family law attorney today.

Contact the Colorado law firm of Husson Law LLC today, and John Husson will closely manage your case from start to finish. He has offices conveniently located in Castle Rock and the Denver Tech Center. Call 719-310-7221 to arrange your free initial phone or video consultation or contact the firm online.